I still remember the first time I received an email that looked like it was from my bank—it had the correct logo, decent formatting, and even referenced my city. But something felt off, so I paused. Because these days, you can’t assume an email truly comes from the institution it claims. In fact, phishing is now one of the most common ways cybercriminals gain access to sensitive data.

Related Page: PROTECTING YOURSELF FROM COMMON SCAMS IN 2025

If you’ve ever wondered … “Is this email really my bank, or is it a scam?” — you’re not alone. The good news is: you can tell. And by the end of this post, you’ll know exactly how to evaluate one of those emails with confidence.

Why This Matters

Let’s take a step back. According to recent data:

- An estimated 3.4 billion phishing emails are sent every single day.

- In Q1 2025, the Anti‑Phishing Working Group (APWG) recorded over 1 million phishing attacks, with nearly 31 % targeting the financial sector.

- The financial sector continues to be a top target due to the “money factor” — you as a bank customer are a high-value target.

What this means for you as a reader — and for us at the community bank level — is that vigilance isn’t optional. Whether you’re a personal account holder or helping a senior citizen (who may be more vulnerable) understand these threats, having simple, actionable steps is key.

The Big Picture: How Phishing Emails Typically Work

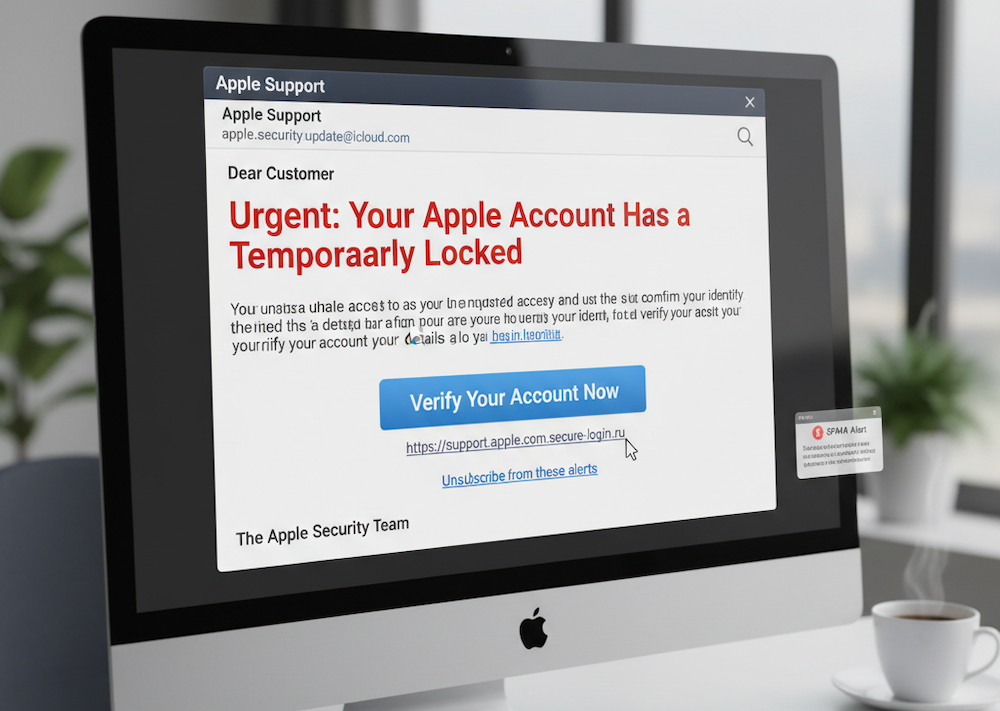

Before we dive into the checklist, it helps to understand the anatomy of a phishing email. These are the usual ingredients:

- The email appears to come from a real institution (your bank, a credit card company, even sometimes your utility provider).

- It induces urgency: “Your account will be closed”, “Verify immediately”, “Unauthorized transaction detected”. Evidence backs this.

- It asks you to click a link, confirm credentials, or open an attachment.

- It may have subtle errors: misspelled words, odd sender addresses, slightly off domain names.

- If you respond, the attacker may steal your login credentials, install malware, or impersonate you to initiate financial transfers.

Knowing that helps you stay mentally prepared. Now let’s walk through step-by-step how to verify an email claiming to be from your bank.

Don’t Let Urgency Drive Your Decision

The first red flag: emails that pressure you to act right now.

When you see such phrases as “Your account will be closed”, “Act within 24 hours”, or “Click immediately to avoid loss”, that’s your cue to slow down.

Why? Because real banks usually don’t demand instantaneous action via email without other forms of verification. The Office of the Comptroller of the Currency (OCC) even states: If you did not initiate the communication, you should not provide any info.

What to do instead:

- Pause.

- Do not click any link in the email.

- Open your bank’s website (or the bank app) via your usual method (not via the link in the email).

- Check your account or call the bank using the phone number on your statement or the back of your card.

Inspect the Sender’s Address and Domain

A lot of phishing emails try to trick you by using an address that looks legitimate—but isn’t.

What to check:

- Is the email address exactly the one your bank uses? For example, does it end in @yourbank.com or something slightly off like @yourbank-secure.com or @yourbound.com?

- Is the “From” name correct but the underlying email address weird? Sometimes it’ll say “Customer Service – YourBank” but the email is “support@yourbank123.com”.

- Look for subtle misspellings in the domain: an “l” instead of “i”, “bank” spelled “bаnk”, etc. IT Governance

- If the domain is a generic public provider (like @gmail.com or @yahoo.com) yet claims to be your bank, that’s a big warning sign.

Action: If you’re unsure, copy the domain (the part after the “@”) and search for that domain + “phishing” or “scam” in your browser. If you find warnings — definitely treat the email as suspicious.

Examine Links and Attachments Without Clicking

One of the cleverest tricks is to make a link look like it goes to your bank, but it actually redirects somewhere malicious.

What to look at:

- Hover your mouse (or press-and-hold on mobile) over a link in the email. Does the link shown in your browser’s status bar match the visible text? If the visible text says “yourbank.com” but the link shown is “yourbank-secure.xyz” or “hxxp://maliciousdomain.com”, that’s problem.

- Are there attachments that you weren’t expecting? Especially .zip, .exe, .docm, or macro-enabled files? These are common malware delivery methods.

- Is the link asking you to “log in” or “verify” via email instead of using your bank’s secure app or portal? The Consumer Financial Protection Bureau and many banks say: always go to the institution’s website directly, not via email links.

Action: If a link or attachment is unexpected — do not click or open it. Instead, access your bank account the way you normally do and check for any messages there. If you see nothing, call your bank and report the email.

Review the Tone, Style & Content for Inconsistencies

Even though phishing has grown sophisticated, there are still tell-tale signs in the writing and structure.

Things to examine:

- Does the greeting use your name and account details, or is it a generic “Dear Customer” or “Valued Member”? Real banks often personalize communications. The Federal Trade Commission (FTC) lists “generic greeting” as one warning sign.

- Are there spelling mistakes, grammatical errors, awkward phrasing? These are less common in genuine communications.

- Is the message inconsistent with your bank’s usual communication style? Maybe the design/layout looks off, the signature is missing, or it uses “urgent action” language that feels unlike your bank.

- Is it making an odd request — for example, “Please send us your password”, “Confirm your PIN”, “Log in right now via this link”?

Action: If anything about the tone or content feels off, treat the email with suspicion and verify by contacting your bank directly.

Check for Additional Clues – Branding, Graphics, Security Warnings

Small design inconsistencies can be red flags:

- Is the bank’s logo low-resolution or slightly different in color?

- Does the email lack the standard footer, contact information, or regulatory disclosure text you typically see?

- If the email contains “secure” badges or icons, do they link to legitimate verification pages (hover to check) or are they just static images?

- Does your email client show warnings like “unknown sender” or “risk of phishing”?

Action: When in doubt, treat design inconsistencies as a reason to verify via phone or the bank’s official website rather than clicking through.

Use Confirmed Contact Methods to Verify

If you’re still unsure, verify directly with your bank using established methods.

Here’s how:

- Don’t call the phone number provided in the suspicious email. Instead, use the number on the bank’s official website, the back of your debit/credit card, or a statement you’ve received. The Microsoft Corporation advice is: “If the message appears to come from someone you know, contact the person via another means… don’t rely on the sender address.”

- Log in to your bank account using the app or by typing the bank’s URL yourself—do not click a link in the email. Then check for alerts within your account (often banks will log security messages there).

- If you’re truly uncertain, you can forward the email (most banks have “abuse@yourbank.com” or a dedicated fraud email) and ask their fraud department if it’s legitimate.

Action: Make the call or log in yourself. Remember: you’re not being paranoid—you’re being cautious.

What If I Clicked the Link or Gave Info? Here’s What to Do

Even with the best intentions, mistakes happen. If you clicked a link or entered information, act quickly:

- Immediately change your bank password using a separate device you know is safe.

- Enable two-factor authentication (2FA) if your bank offers it (many do and strongly recommend it).

- Review your recent account activity for unauthorized transactions.

- Contact your bank’s fraud or security department. Let them know what happened.

- Monitor your credit report or bank statements for unusual activity.

- Consider running a security scan on your computer or device to see if malware was installed.

By acting early you reduce the damage potential significantly.

Preventive Habits That Keep You Safe

Verification is great — but prevention is even better. Here are some good habits:

- Always keep your devices and software up to date. Many phishing attacks succeed via outdated systems.

- Use strong, unique passwords for your banking login and change them periodically.

- Activate multi-factor authentication (MFA/2FA) whenever possible — this adds a second layer of security beyond your password.

- If your bank offers alerts (text, email) for transactions or login attempts, activate them.

- Educate yourself and those around you (especially older family members) about phishing and its signs — awareness is one of the best defenses.

- Use your bank’s official app rather than logging in via email link-pop ups.

- If you receive any suspicious email, screenshot it, forward it to your bank’s fraud dept, then delete it.

Frequently Asked Questions

Q: My bank just emailed saying there’s suspicious activity—how do I know if it’s real?

A: Assuming your bank has your correct email and contact details, the first thing to ask is did you already initiate any transaction or change? If not, go to your bank’s website or call them directly to verify — don’t click a link in the email.

Q: What if the email came from “info@mybank-secure.com”?

A: That’s often a warning sign. Real bank domains are consistent — e.g., “@mybank.com” — and they typically don’t add extra words like “secure” or “-update” unless clearly communicated previously. Always check.

Q: Can I trust an email if I used the bank’s official app to log in and saw no alerts?

A: Yes. If you log into your account using an independent method (not via emailed link) and you see no alerts or holds, chances are the email is phishing. However, still submit it to the bank’s fraud team so they can monitor.

Q: My bank says “We’ll never ask you to log in via email link.” Is that standard?

A: Many banks do say this explicitly — e.g., the OCC’s guidance: “A financial institution would never ask you to verify your account information online” via unsolicited email. OCC.gov It’s a good policy to lean on.

Why Community Banks Like Us Should Emphasize This

At a local community bank, trust is the foundation. When our customers get an email claiming to be from us, and it turns out to be a scam, it erodes confidence — not just in technology, but in the relationship.

That’s why:

- We want you to feel empowered, not intimidated.

- By sharing these best practices, we strengthen the entire local banking ecosystem.

- If you teach someone else (a parent, a friend) how to handle a suspicious email, you’re protecting them and our community.

Remember, we’re not just selling accounts — we’re protecting your financial well-being. When you spot a phishing email before it becomes a problem, you become our partner in that mission.

A Quick “If You Want to Double-Check” Cheat Sheet

Before clicking anything in an email that claims to be from your bank, run through these five quick checks:

- Urgency & Threat – Does it demand immediate action or threaten consequences?

- Sender Address – Is the email domain exactly correct, or subtly off?

- Links/Attachments – Hover before clicking, and avoid unexpected attachments.

- Tone & Content – Generic greeting? Misspellings? Unexpected request for credentials?

- Verification – Log in yourself via the official app/website or call the bank. Don’t rely on anything in the email itself.

If any one of these is off — stop, verify, and report.

Your Role Is Key

Scams don’t happen because we’re lazy. They happen because they look legitimate, and sometimes they catch us when we’re rushed, distracted, or under pressure. But you can flip the script.

By adopting a mindset of “verify first”, you protect your accounts, your identity, and your peace of mind. Here at our community bank, we’re always here to help — but the first step is on you. Pause. Examine. Question. If you ever see an email that gets your radar up — give us a call, forward it to us, and we’ll walk you through it.

We’re not just keeping you financially healthy — we’re keeping you secure. And when it comes to phishing emails, your question “Is this really from my bank?” is the most important one you can ask.