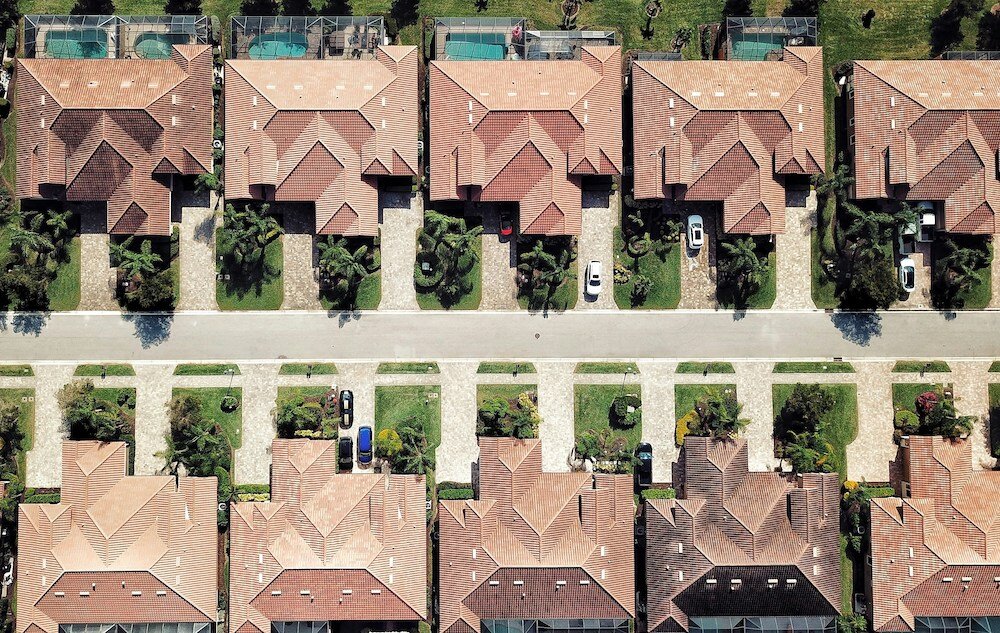

Florida's sunshine and beaches make it a perpetual magnet for dreamers and retirees alike. But that sunshine state charm comes with a price tag, especially when it comes to real estate. As you embark on your homeownership journey in Florida, understanding the financial landscape is crucial. This article will delve into the costs associated with buying a home in Florida, helping you determine the magic number you need to save for your dream property.

Tools: First Time Homebuyers Guide

The Down Payment:

A Cornerstone of Affordability

The down payment is often the first hurdle potential homebuyers face. It represents a portion of the purchase price you pay upfront, reducing the amount you need to borrow through a mortgage. A higher down payment offers several advantages:

Lower Monthly Payments

A larger down payment translates to a smaller loan amount, resulting in a lower monthly mortgage payment. This frees up more of your monthly income for other expenses and improves your overall financial flexibility.

Favorable Loan Terms

Lenders view borrowers with a sizable down payment as less risky. This can translate into lower interest rates, saving you thousands of dollars over the life of the loan.

Private Mortgage Insurance (PMI) Avoidance

If your down payment is less than 20% of the purchase price, you'll likely be required to pay PMI, an additional monthly fee that protects the lender in case of default. A 20% down payment eliminates this expense.

How much should you aim for in terms of a down payment?

The traditional benchmark is 20%. However, there are options available for those who might not have that much saved yet.

- Conventional Loans

These loans require a minimum down payment of 3% but come with stricter credit score requirements. - FHA Loans

The Federal Housing Administration (FHA) offers loans with a minimum down payment of 3.5%. These loans are often a good option for first-time homebuyers with limited savings.

Beyond the Down Payment: Additional Costs

While the down payment is a major factor, it's not the only financial hurdle to consider. Here's a breakdown of some additional closing costs associated with buying a home in Florida:

- Origination Fee

This is a one-time fee charged by the lender to process your loan application. Typically, it ranges from 0.5% to 1% of the loan amount. - Discount Points

These are upfront fees paid to the lender in exchange for a lower interest rate on your mortgage. - Appraisal Fee

This covers the cost of an appraisal, which is an independent assessment of the property's value. - Title Insurance

This protects you from any ownership claims against the property. - Escrow

This account holds funds for property taxes, homeowner's insurance, and other recurring costs. You'll typically need to prepay several months' worth of these expenses at closing. - Home Inspection

An inspection by a qualified professional is vital to uncover any potential problems with the property. - Attorney Fees

While not always mandatory, some homebuyers choose to hire an attorney to review the closing documents.

Understanding Your Target Market

Florida's real estate market is diverse, with significant price variations depending on location, property type, and market conditions.

Here's what you need to consider:

Location

Prices can vary dramatically between coastal areas, major cities, and rural communities. Research the average home price in your desired area to set realistic expectations.

Property Type

Single-family homes, condos, and townhomes all have different price ranges. Factor in your lifestyle needs and budget when making a choice.

Market Conditions

The Florida housing market, like all markets, is subject to fluctuations. Be aware of current trends and be prepared to adjust your budget if necessary.

Financing Considerations

The interest rate on your mortgage significantly impacts your monthly payment and total loan cost. Here are some factors to consider when securing financing:

- Credit Score

A higher credit score qualifies you for better interest rates. Aim to improve your credit score before applying for a mortgage. - Debt-to-Income Ratio

This ratio compares your monthly debt payments to your gross monthly income. A lower ratio makes you a more attractive borrower and can lead to a lower interest rate. - Loan Type

Different loan types have different interest rates and requirements. Explore options like fixed-rate or adjustable-rate mortgages to find the one that best suits your financial goals.

Saving Strategies for Your Florida Dream Home

Building your down payment and savings can seem daunting, but with a strategic approach, you can reach your goal. Here are some tips to get you started:

Create a Budget and Track Your Spending

Knowing where your money goes is the first step to making informed savings decisions. Track your income and expenses to identify areas where you can cut back.

Prioritize Saving

Set realistic savings goals and automate transfers to a dedicated savings account. Consider increasing your savings contribution as your income grows.

Explore Down Payment Assistance Programs

Several programs offered by government agencies and non-profit organizations can help with down payment costs. Research options available in your area and eligibility requirements.

Reduce Debt

High debt payments can eat into your savings potential. Focus on paying down existing debts to free up more income for saving.

Consider Alternative Housing Options

While a single-family home might be the ultimate dream, consider starting with a condo or townhouse if it fits your budget better. This allows you to enter the market sooner and build equity.

The Road to Homeownership: It's a Marathon, Not a Sprint

Buying a home in Florida is an exciting yet financially significant endeavor. By understanding the costs involved, from down payments to closing fees, you can create a realistic budget and develop a savings plan. Remember, consistent saving and responsible financial management are key to achieving your homeownership dreams.

Additional Resources:

By taking the time to research, plan, and save, you can turn your Florida dream home into a reality.