At some point, nearly everyone worries about their credit. Maybe it’s a lower-than-expected score when you apply for a car loan. Maybe it’s a denial letter that arrives in the mail without much explanation. Or maybe you’re simply trying to do the right thing and improve your financial footing for the future.

Related Page: The Top Scams and Fraud Threats to Watch for in 2026 (and How to Protect Yourself)

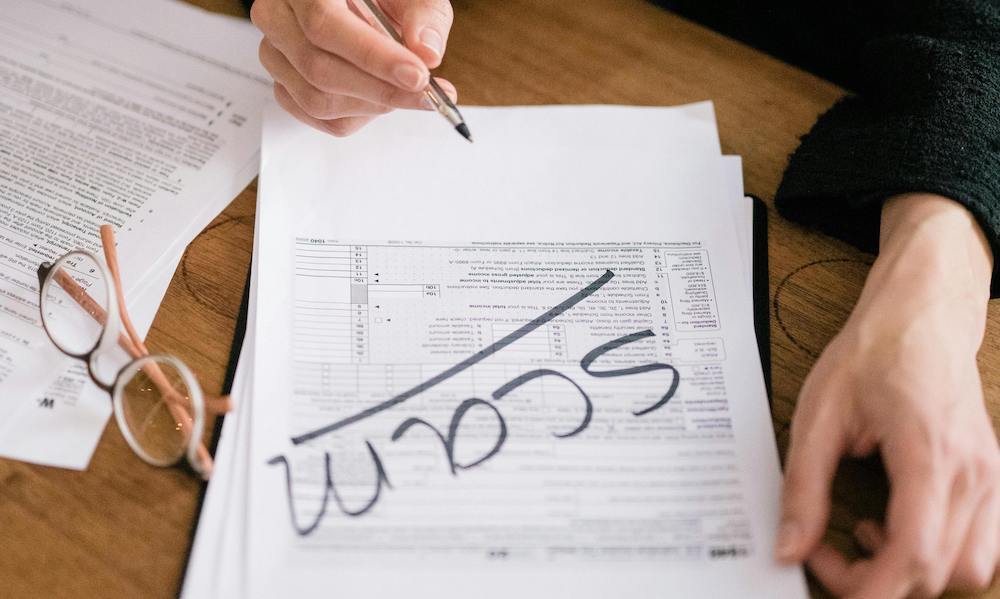

When you’re stressed about credit, it’s easy to feel overwhelmed — and that’s exactly the moment when illegal credit repair scams tend to show up. They promise fast results, secret loopholes, and instant fixes. They sound confident. They sound convincing. And unfortunately, they often leave people worse off than when they started.

As a community bank, we see the real-world impact of these scams every day. Neighbors who thought they were getting help end up with drained bank accounts, damaged credit, and fewer options than before. That’s why we want to be very clear: an illegal credit repair scam is not the answer — and there is a better, safer path forward.

This guide is designed to help you understand how credit really works, how to spot illegal credit repair practices, and what legitimate, long-term credit improvement actually looks like.

Why Credit Repair Scams Are So Tempting

Fixing credit is rarely fast. It takes time, consistency, and patience — three things that are hard to come by when you’re feeling financial pressure. Scammers know this.

They also know that most people don’t spend their free time reading credit reporting laws or studying how scores are calculated. That knowledge gap creates an opening.

The Emotional Pressure Behind Credit Decisions

Credit touches some very personal parts of life:

- Buying a home

- Replacing a car

- Renting an apartment

- Starting a small business

- Even qualifying for certain jobs

When those goals feel blocked by a number on a credit report, emotions can take over. Fear. Frustration. Embarrassment. A sense of urgency.

Scammers don’t just sell services — they sell relief. And that’s what makes them dangerous.

“Too Good to Be True” Promises

Most illegal credit repair scams rely on a familiar formula:

- “We can erase bad credit, guaranteed.”

- “We’ll remove accurate negative items.”

- “You’ll see results in 30 days or less.”

- “No need to talk to creditors.”

Here’s the truth: there is no legal way to instantly remove accurate, negative information from your credit report.

If someone says otherwise, that’s your first red flag.

What Credit Repair Really Means (And What It Doesn’t)

Before we talk about scams, it helps to clarify what legitimate credit repair actually is.

The Legal Definition of Credit Repair

Credit repair, at its core, means:

- Reviewing your credit reports for errors

- Disputing inaccurate or incomplete information

- Building positive credit habits over time

That’s it.

It does not mean:

- Hiding past mistakes

- Creating a new credit identity

- Removing accurate late payments or collections

- Gaming the system

Under the Fair Credit Reporting Act (FCRA), you already have the right to dispute inaccurate information on your credit report — for free. You can read the law directly from the Federal Trade Commission here.

Anyone charging you for access to “special” dispute rights is misrepresenting the law.

What Legitimate Help Can Look Like

Legitimate credit help may include:

- One-on-one financial counseling

- Education on budgeting and debt management

- Help understanding your credit reports

- Coaching on how to rebuild credit responsibly

These services focus on empowerment, not shortcuts.

Common Illegal Credit Repair Scams to Watch Out For

Let’s break down the most common tactics we see — and why they’re illegal or harmful.

Charging Fees Before Any Work Is Done

Under the Credit Repair Organizations Act (CROA), credit repair companies are not allowed to charge upfront fees before services are performed.

If a company demands payment before doing anything, that’s a major warning sign.

You can read more about CROA protections here.

Advising You to Dispute Accurate Information

Some scammers encourage clients to dispute everything on their credit report — even items that are clearly accurate.

This can:

- Waste time

- Delay real progress

- Damage your credibility with creditors

Disputes are meant for errors, not regrets.

Telling You to Stop Paying Your Bills

This one is especially dangerous.

Stopping payments can:

- Lower your credit score further

- Trigger collections or lawsuits

- Add late fees and interest

No legitimate credit professional will ever tell you to intentionally default as a “strategy.”

Creating a New Credit Identity (CPN or EIN Scams)

Some scams suggest you apply for credit using a “Credit Privacy Number” or a business EIN to start fresh.

This is not credit repair. It’s fraud.

Using a false identity to apply for credit can carry serious legal consequences.

How Illegal Credit Repair Can Make Things Worse

Ironically, many people seek out credit repair scams because they want to avoid long-term damage. Instead, they often create more of it.

Financial Loss

Scam victims may pay hundreds or thousands of dollars for services that do nothing — or actively harm them.

That’s money that could have gone toward:

- Paying down balances

- Building emergency savings

- Covering necessities

Lower Credit Scores

Aggressive, improper disputes and missed payments often cause scores to drop, not rise.

Fewer Banking Options

Banks and lenders look for patterns of responsibility and transparency. Fraud-related activity can limit your future options.

Once trust is broken, it’s hard to rebuild.

How to Spot a Credit Repair Scam Quickly

When you know what to look for, most scams reveal themselves pretty fast.

Red Flags to Remember

Be cautious if a company:

- Guarantees specific score increases

- Promises instant results

- Refuses to explain their process clearly

- Asks you to sign blank forms

- Tells you to lie on applications

- Discourages direct communication with creditors

If something feels off, trust that instinct.

The Right Way to Fix Your Credit — Step by Step

Now for the good news: credit improvement is possible, and it doesn’t require secrets or shortcuts.

Step 1: Get Your Free Credit Reports

You’re entitled to free reports from all three bureaus at: https://www.annualcreditreport.com

Review them carefully. Look for:

- Incorrect balances

- Accounts that aren’t yours

- Wrong payment statuses

- Outdated information

Step 2: Dispute Legitimate Errors

If you find inaccuracies, file disputes directly with the credit bureaus.

This process is free, and the bureaus are required to investigate.

Step 3: Pay Bills On Time — Every Time

Payment history is one of the biggest factors in your credit score.

Even one missed payment can set you back.

Automatic payments can help remove the guesswork.

Step 4: Reduce Credit Card Balances

Lower balances improve your credit utilization ratio — another major scoring factor.

You don’t need perfection. Progress matters.

Step 5: Build Positive Credit History

This may include:

- Secured credit cards

- Credit-builder loans

- Responsible use of existing accounts

Consistency over time is what counts.

How a Community Bank Can Help (Without Scams)

At a community bank, our approach is different by design.

We don’t sell magic fixes. We build relationships.

Education First

We believe informed decisions lead to better outcomes. That’s why we focus on:

- Explaining credit in plain language

- Helping you understand your options

- Answering questions without pressure

Personalized Guidance

Your financial story is unique.

We look at the full picture — not just a score — and help you map realistic next steps.

Long-Term Support

Credit improvement isn’t a one-month project. It’s a journey.

We’re here to walk it with you.

Real Progress Beats Risky Promises

If you’re looking to fix your credit, you’re already taking an important step. That desire to improve — to plan ahead, to do better — matters.

Illegal credit repair scams prey on that motivation, offering shortcuts that don’t exist and solutions that cause real harm.

The truth is quieter, but far more empowering: credit can be rebuilt legally, ethically, and sustainably. It takes time. It takes patience. And it takes support you can trust.

As a community bank, we’re proud to be a place where questions are welcome, conversations are honest, and progress is measured in real outcomes — not empty promises.

If you’re unsure where to start, stop by, give us a call, or explore our financial education resources. We’re here to help — as neighbors, not salespeople.

Because in our community, doing things the right way always matters.