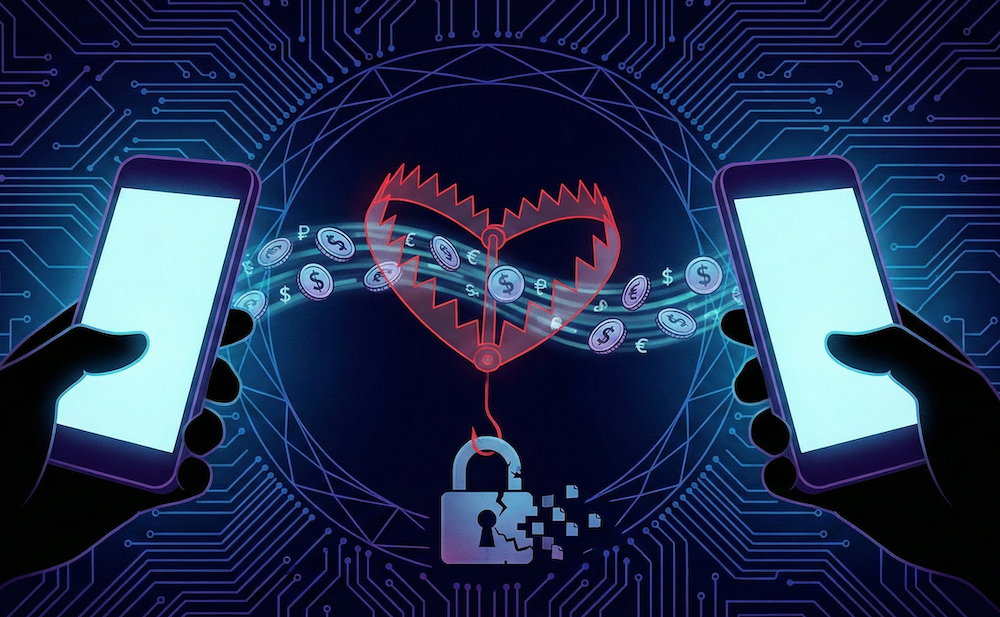

When someone insists that you “just Venmo me” or “send it through Cash App,” it feels simple enough. After all, we use peer-to-peer (P2P) payment apps every day - for splitting dinner, paying friends back, or reimbursing a coworker for coffee. But the moment you use these apps with someone you don’t personally know and trust, the risk skyrockets.

Related Page: The Top Scams and Fraud Threats to Watch for in 2026 (and How to Protect Yourself)

In 2024 alone, Americans lost millions to P2P payment scams, and the numbers continue to climb. One reason is simple: payments made through Venmo, Cash App, and similar services are instant, irreversible, and designed for people who already know each other. That combination makes strangers the most dangerous category of users you can interact with on these platforms.

This guide walks you through the risks, the scams, the red flags, and the safer alternatives - especially for people here in our Florida communities. Our goal is to help you understand how to use these tools wisely, protect your money, and stay one step ahead of the growing wave of digital fraud.

Why P2P Payment Apps Feel Safe - but Aren’t

P2P apps exploded in popularity because they solved everyday problems. They’re fast. They’re convenient. And they make splitting a bill less awkward. But the features that make these apps friendly also make them vulnerable.

They Weren’t Built for Strangers

Venmo and Cash App were created to transfer money between friends. Not buyers and sellers. Not tenants and landlords. Not marketplace strangers. When fraud happens, the responsibility typically falls on the sender - not the platform.

Payments Can’t Be Reversed

Once you tap “Send,” the money is gone. Unlike credit cards or debit cards, you don’t have the ability to file a standard dispute for most transactions. These apps treat your payment as intentional, even if you were tricked.

No Buyer Protection

If you buy something on Facebook Marketplace, Craigslist, or another local platform and never receive the item, you often have no recourse. The app can’t force the other person to return your money.

Scammers Know All of This

Fraudsters love P2P apps because:

- Transfers happen instantly

- The sender holds all liability

- No product verification is required

- There’s little risk of getting caught

That’s why these platforms have become one of the fastest-growing avenues for digital scams.

What Happens When You Send Money to a Stranger

People often assume P2P apps work like PayPal or a credit card. Unfortunately, they don’t.

When you send money to a stranger:

- You can’t cancel the payment

- You can’t reverse it

- The platform doesn’t guarantee refunds

- Your bank often can’t recover the funds

And if the person blocks you - or deletes their account - you may have no way to contact them again.

This is why most P2P apps state clearly in their user agreements: only send money to people you trust.

The Most Common Venmo and Cash App Scams

Scammers continuously evolve their tactics, but several patterns show up again and again, especially in Florida.

Marketplace Scams (Facebook Marketplace, Craigslist, OfferUp)

This is the most common scenario. A seller insists on receiving payment before you meet. They promise to “hold the item.” Or they send a fake screenshot showing they’ve “already paid you,” and now you just need to “refund” the difference.

Typical pattern:

- You agree to buy an item.

- The seller asks for a Venmo or Cash App payment upfront.

- After you pay, they disappear.

No item. No recourse. No refund.

The “Accidental Payment” Scam

A stranger “accidentally” sends you money and begs for it back.

Of course, the original payment was made with a stolen card.

If you send the money back:

- The stolen card transaction is reversed.

- Your “refund” comes out of your pocket.

- You end up paying the fraudster.

Rental Deposit Scams

Florida has a high volume of rental turnover and seasonal leases, making us a hot target.

Scammers often:

- Post fake rental listings

- Ask for security deposits via P2P apps

- Vanish once the payment is made

Because these apps aren’t meant for business or rental transactions, there’s virtually no buyer protection.

Advance Fee Scams (“Pay This Fee and I’ll Release the Money”)

A fraudster pretends to be sending you money, but claims:

- You need to pay a “processing fee”

- Or “unlock your account”

- Or “verify your identity”

Once you pay, the scam ends - because there was never any money to begin with.

Fake Job or Side-Hustle Scams

These are common in college towns and tourist areas.

A scammer offers a job, sends you a “bonus” or “prepayment,” and instructs you to return part of it. The original payment is fraudulent. You lose the money you sent back.

Romance & Relationship Scams

Scammers build trust through:

- Dating apps

- Social media

- Online communities

Once you feel connected, they ask for help with:

- Bills

- Travel

- Emergencies

And they insist on Venmo or Cash App because it's fast and has limited protections.

Why These Scams Are Common in Florida

Florida is one of the top states for digital payment fraud, for several reasons:

High Volume of Marketplace Transactions

Florida’s housing turnover, tourism, and seasonal economy create a fertile environment for buying and selling online.

Large Senior Population

Seniors often use P2P apps to pay caregivers, contractors, or service providers - making them targets.

Vacation Rentals and Short-Term Leases

Scammers prey on people moving into the area or looking for seasonal housing.

Transient Populations in Coastal Communities

Scammers can operate anonymously and move quickly from place to place.

Red Flags to Watch For

Whenever a stranger suggests using Venmo or Cash App, pay attention to these signs:

“Can you pay before we meet?”

Never do this. Ever.

“I’ll send you a screenshot as proof.”

Easy to fake. Worthless for verification.

“I sent the wrong amount - can you refund it?”

Almost always a scam.

“Pay through Cash App instead of meeting in person.”

This is the fraudster’s dream scenario.

“My account is locked - send money to this other username.”

Clear fraud.

A price that’s too good to be true

It usually is.

What to Do If You’ve Already Sent Money

If you think you’ve been scammed, act quickly. Here are the steps we recommend:

1. Contact the app’s support team immediately

Report the transaction as unauthorized. They may not reverse it, but they will flag the account.

2. Contact your bank

Explain the situation. While authorized payments are hard to recover, your bank can guide next steps and help secure your accounts.

3. File a report with the FTC

4. Report the user to the platform where you met them

Facebook Marketplace, Craigslist, OfferUp, etc.

5. If you sent sensitive info, freeze your credit

Freezing is free with all three major credit bureaus.

6. Tell trusted friends or family

Scammers rely on secrecy. Speaking up protects others.

Safer Alternatives for Marketplace Transactions

If you're buying or selling locally - especially here in Sarasota and Manatee County - use safer options like:

Cash in person

Meet in a public place, confirm the item, then pay.

A verified payment at the buyer’s or seller’s bank

We see customers do this all the time. Both parties meet at the bank, where the transfer happens securely.

A cashier’s check from a trusted financial institution

Best for high-ticket items.

Bank-issued P2P tools with authentication safeguards

Your community bank likely offers safer digital transfer tools than third-party apps.

How to Use P2P Apps Safely (When You Do Know the Person)

Using Venmo and Cash App with friends can be safe - if you follow these guidelines:

- Double-check usernames before sending

- Set privacy settings to “Private”

- Enable multi-factor authentication

- Don’t store large balances in the app

- Move money to your bank account quickly

- Avoid clicking links in texts or DMs

- Never accept payments from strangers

These steps dramatically reduce risk when using P2P apps in your normal daily life.

How Community Banks Help Protect You

As a local community bank, our role isn’t just to hold your money - it’s to help you protect it.

We’re here to:

- Provide safer payment options

- Help you understand fraud red flags

- Assist you if you’ve been targeted

- Offer in-person support when something feels off

- Teach your family (including teens and seniors) how to use digital tools wisely

Because we live and work in the same community you do, we care deeply about keeping your finances secure.

Staying Safe Together

P2P payment apps make everyday life easier - but only when used with people you know and trust. When strangers enter the equation, the risks become real, immediate, and costly.

Our goal is to give you the knowledge and confidence to navigate digital payments safely. If something feels off, if a request seems strange, or if you want a second opinion before sending money - reach out to us. We're here to help you stay protected, informed, and empowered.

Because in a close-knit community like ours, looking out for each other is more than good practice - it’s who we are.